Pasadena Tax Resolution Attorney

Address Your State Tax & IRS Issues Now

- Get the strongest legal counsel and a thorough case evaluation to help you resolve your tax issue.

Obtain a better chance to reach a settlement with the IRS.

Receive complete attention from beginning to end.

At the Law Office of Daniela Romero, APLC, we know the tax law, and we can help you resolve any tax issues you may have, such as back taxes, audit representation, and more! Daniela Romero is dedicated to helping California residents get out of debt. With her years of experience, she can help you resolve all of your tax debts quickly and easily. Call us today to schedule a free initial consultation and speak with a trusted tax resolution attorney!

Here’s Why You Need a Pasadena Tax Resolution Attorney

Without the right tax resolution assistance, tax penalties pile up. Working with our Pasadena tax resolution attorney could:

- Free you of the stress and anxiety of dealing with the IRS

- Help you navigate through the complicated legal system

- Help you understand the Tax Law and what you are going through

- Find a solution to your tax issue

At Daniela Romero Law, we help people resolve tax problems and stop IRS actions against them quickly and for much less than what you currently owe.

We can help with:

Years of Unfiled Tax Returns

Back Taxes

Tax Liens and Levies

Audit Representation

Wage Garnishment

You should rectify your tax issue as quickly as possible. Professional assistance with tax resolution will reduce stress and headaches while ensuring you don’t overpay the IRS.

The Daniela Romero Law 3-Step Tax Resolution Process

We Consider Your Concern and Look for the Best Resolution

At Daniela Romero Law, the first order of business is continually establishing connections with our clients. We will sit down and listen to your tax concerns, educate you on the tax law, and develop strategies. Our Pasadena tax resolution lawyers will carry on client protection procedures, perform full case assessment, open communication with IRS or State, and continue building an action plan.

Document Compilation for IRS Compliance

The next step is the compilation of documents in compliance with IRS requirements. We ensure that every step of this process is done correctly so that you pay no more than you owe. Once we have prepared all necessary documents and strategized our presentation, we will challenge the IRS and allow us to be heard. Privacy is important to us, so we ensure that all essential documents and information will be kept confidential once we proceed with your tax resolution.

We Get You Set Up to Avoid Tax Problems

Our service here at Daniela Romero Law does not take a full stop at just resolving one tax issue. After we succeed in determining your tax, we will make sure to inform you and guide you through the correct process to avoid any tax problems in the future.

You Don’t Have to Face the IRS Alone

Taking on the IRS without a tax resolution attorney is like trying to rewire your home without an electrician. Maybe it can be done but should you? The answer is “NO” unless you want the IRS to short out and burn down your house metaphorically. Paying a non-attorney tax resolution service to help you with the IRS is not much better.

A non-attorney tax resolution service cannot represent you in court or give you legal advice if you face real problems. You will need to hire a tax resolution attorney anyway, and the tax resolution service isn’t going to give you a refund. So, why not start with our Pasadena tax attorney on your side?

Before hiring one of those tax resolution services, call us. We’ll give you a free state and federal tax debt analysis and discuss your options with no high-pressure sales or obligations. We’ll just give you straight answers and sound advice. Call us today!

Stop IRS Harassment Today!

Is the IRS sending threatening letters, or have they already started collection actions? The IRS can seize your assets, like your home and business, without a court order! You won’t deal with the IRS with us on your side anymore. If you act now, we may be able to stop the IRS before it’s too late.

Your Tax Problem Resolved, Think Tax Relief!

Get in touch with us today! You are one step to reaching tax resolution by sending us a message or calling our law firm to discuss your tax concerns. Our Pasadena tax attorney has done thousands of tax resolution cases to know what works best and what does not come out with good results. Obtain tax relief now, and be able to avoid other tax problems in the future. Remember that tax penalties pile up quickly, and there is no better time to act than now.

Frequently Asked Question on Tax Resolution in Pasadena

PASADENA and SAN GABRIEL VALLEY BANKRUPTCY LAWYER

Call us Today: 626-296-6971

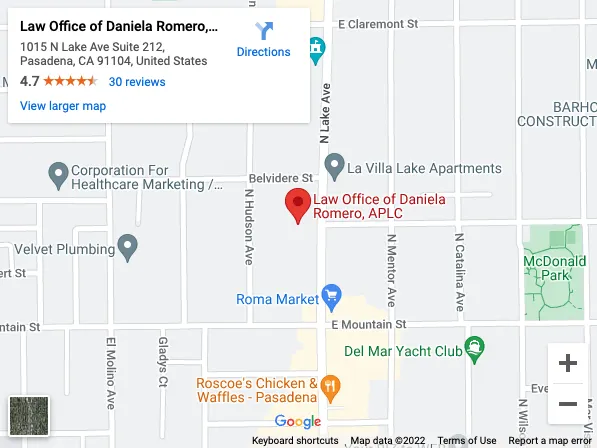

1015 North Lake Ave., Ste. 212, Pasadena, California 91104

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code. The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute an attorney-client relationship.